2024 has gotten off to a scorching begin within the inventory market. The S&P 500 is up 7%, whereas the tech-heavy Nasdaq Composite has rallied 6% as synthetic intelligence (AI) euphoria continues to dominate.

One firm that appears to have misplaced its groove, nevertheless, is Snowflake (NYSE: SNOW). Shares of the database administration firm are down 21% to this point this yr. The rationale? Issues are rising that Snowflake has fallen behind within the AI gold rush.

Let’s dig into the present standing of Snowflake and analyze why this as soon as high-flying inventory may proceed spiraling downward.

A fall from grace

In Sept. 2020, Snowflake introduced the warmth following its extremely anticipated preliminary public providing (IPO). In actual fact, Snowflake was the biggest software IPO of all time.

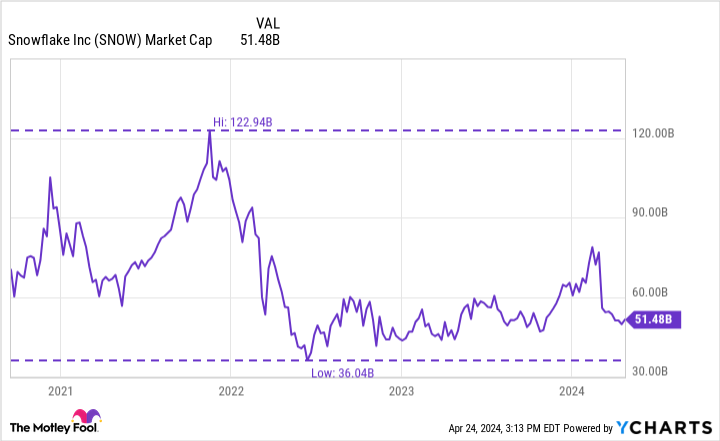

Within the months following its debut on the New York Stock Exchange, Snowflake’s market cap rocketed to over $100 billion. However after peaking at a valuation of $123 billion on the finish of 2021, Snowflake is now value simply barely greater than $50 billion.

The competitors is profitable to this point

During the last yr, one of many dominant themes fueling the capital markets has been AI.

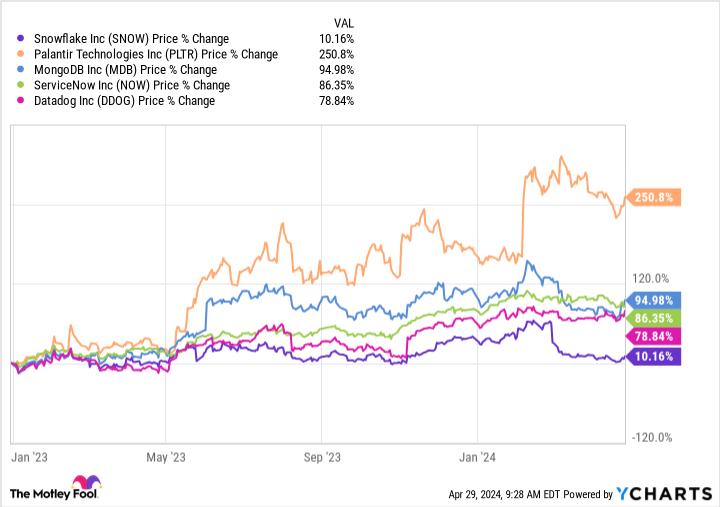

Lots of Snowflake’s software-as-a-service (SaaS) friends reminiscent of Palantir, ServiceNow, Datadog, and MongoDB have made notable strides within the AI realm with their shares surging because of this.

That hasn’t been the case for Snowflake, which additionally noticed a pointy selloff earlier this yr following the abrupt departure of CEO Frank Slootman. Snowflake buyers have been left with little to cheer about.

Considered one of Snowflake’s major opponents is AI and machine studying start-up Databricks, a non-public firm that boasts “Magnificent Seven” member Nvidia as considered one of its buyers.

Earlier this month, Databricks CEO Ali Ghodsi dissed Snowflake throughout an interview with Bloomberg. Ghodsi proclaimed that Snowflake “principally was not doing any AI in anyway.”

Whereas that is simply the opinion of 1 competitor, Ghodsi’s rationale was attention-grabbing. He went on to clarify the first performance of Snowflake’s knowledge warehousing software program is to ask questions concerning the previous. Nevertheless, he alludes that AI goals to be a “predictive” software.

It is onerous to argue with Ghodsi. Whereas I’ve expressed beforehand that I do not see Snowflake as a direct menace to Palantir, the 2 firms are sometimes benchmarked towards each other on this planet of enterprise software program.

2023 was a milestone yr for Palantir — the corporate’s profitable inroads in AI have helped generate sturdy progress on each the highest and backside traces.

With buyers souring on Snowflake, let’s assess some strikes the corporate is making and what it may imply in the long term.

The blizzard is way from over

Though Slootman’s departure was jarring, there was a silver lining. Snowflake named Sridhar Ramaswamy as its new CEO. His prior position on the firm? Senior vp of AI.

Ramaswamy truly joined Snowflake in Might 2023 after the corporate acquired his AI start-up Neeva. Previous to co-founding Neeva, Ramaswamy spent 15 years at Alphabet rising its promoting enterprise right into a $100 billion empire.

General, I am cautiously optimistic about this variation in management. Ramaswamy has expertise in each bringing new merchandise to market and functions revolving round AI.

Since Ramaswamy assumed the CEO place on the finish of February, Snowflake has already made a significant announcement. In late April, the corporate launched its personal massive language mannequin, known as Arctic. In keeping with the press launch, Arctic is most corresponding to Meta‘s Llama generative AI mannequin.

For now, I would sit on the sidelines and regulate Snowflake. Contemplating how unstable the inventory has been and the evolving AI panorama, Snowflake may proceed sliding if it does not begin gaining floor towards its opponents.

Whereas Ramaswamy very effectively could also be an improve from prior administration, buyers ought to await proof his imaginative and prescient is driving the corporate ahead. The discharge of Arctic clearly demonstrates Snowflake’s dedication to AI, however the query is that if such strikes are just too little, too late.

Must you make investments $1,000 in Snowflake proper now?

Before you purchase inventory in Snowflake, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Snowflake wasn’t considered one of them. The 10 shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $537,557!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Meta Platforms, Nvidia, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Datadog, Meta Platforms, MongoDB, Nvidia, Palantir Applied sciences, ServiceNow, and Snowflake. The Motley Idiot has a disclosure policy.

Here’s 1 Artificial Intelligence (AI) Stock I’m Avoiding Like the Plague was initially revealed by The Motley Idiot